Image Credit : Credit Sesame

Project Overview

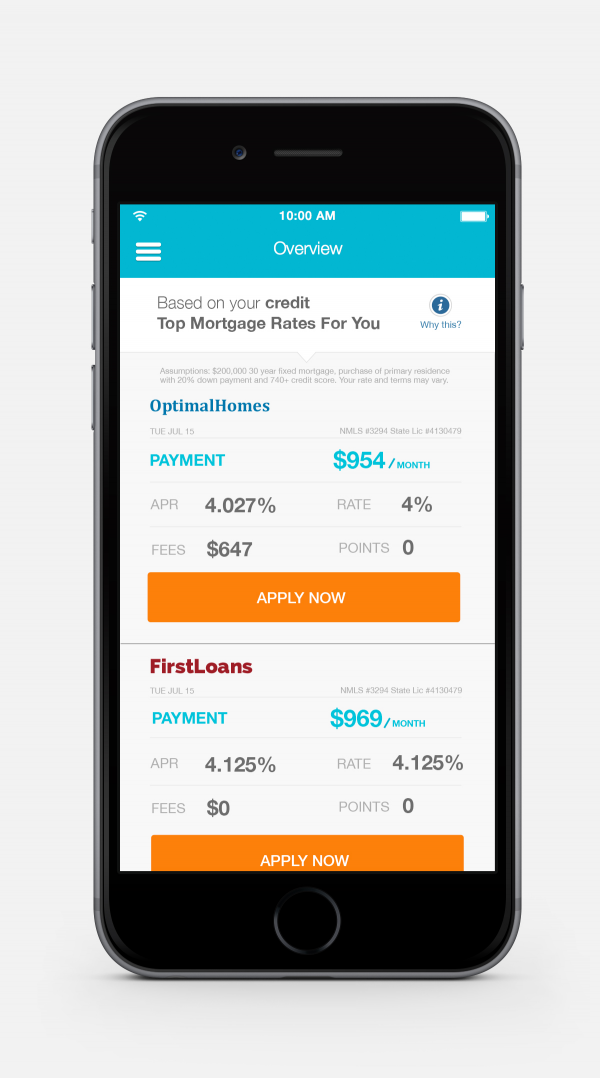

Credit Sesame is a free mobile app that pulls your credit information from TransUnion so reviewing your credit accounts, different debts, and other factors that influence your credit score is made easy and intuitive.

Our advanced analytical technology understands your credit and debt to give your customized recommendations on which cards or loans to choose so you can save money.

Organisation

Team

The Credit Sesame app was developed in-house by www.creditsesame.com and is currently led by our Head of Mobile, George McMullen. The Credit Sesame mobile app project was a group effort by the design, product and mobile teams at Credit Sesame.

Project Brief

At Credit Sesame, we believe that knowing your credit worthiness is vital to your financial well being, and that is why offering you this free service is an important part of our company. Our patented analysis takes a look at your credit history and any debt situation daily and advises you on where you may be overpaying so that you can save big on loans, credit card debt, and your home mortgage.

Aside from some key benefits include:

- Credit monitoring alerts whenever there is a change in your credit

- With Credit Sesame you also get $50,000 in identity theft insurance, plus fraud resolution assistance - for free.

- A premium subscription that gives you access to enhanced identity theft alerts as well as all your credit information from all three credit bureaus

Project Need

Credit Sesame has long been a leader in the consumer finance and credit industry. Credit Sesame developed and released the first app that empowered people with the ability to get their credit score for free and was the first company to launch a completely free identity protection service on both mobile and web. The company continues to innovate by providing users with deeper insight into their credit and debt, and how it can affect their future financing options on credit cards, mortgages, loans and more.

Finally, as the world continues to be more and more mobile-centric, Credit Sesame is taking advantage of the power of mobile to provide users with timely data and financing options that are relevant not just to their credit profile, but their current location as well. Instead of just promoting large national companies, Credit Sesame also has access to thousands of smaller, local lenders and financing services that provide a more personalized touch to lending.

User Experience

Credit Sesame has an incredibly engaged audience on multiple levels. As a financial services product, users are highly interested in understanding and updating their data, and also highly focused on improving their credit, reducing debt and finding ways to save money on their credit cards and loans.

Because of this, Credit Sesame’s user engagement is bi-directional. Users actively log in to the app and website to get the latest information and deals; Credit Sesame also actively engages with users in a multi-platform manner, through push notifications, emails and more, alerting users to changes in their data or updates in deals. This two-way communication continues to drive our highly engaged audience back to our service.

Project Marketing

To promote our mobile app, our main Marketing strategy has been to advertise on Facebook. We have launched several Facebook ad campaigns that reach hundreds of thousands of people every day. We are thoughtful in choosing targeting specific demographics that would benefit from the services provided by Credit Sesame.

As a strong consumer advocate, Credit Sesame provides consumers the industry’s best free financial tools, resources and educational materials tools they need to manage their financial wellness and reach their financial goals. Credit Sesame has helped more than eight million registered users find better financial products and do more with their credit score. It’s difficult to know which credit and loans are the best for each individual without any help. That’s why Credit Sesame offers a total solution: a simple, complete picture of credit and loans in one place.

The Credit Sesame mobile app allows users to easily and seamlessly manage their credit and debt and to get the latest information and deals. They also get push notifications, emails, and alerts when changes in their data occur.

Project Privacy

With Credit Sesame, user information is always encrypted. The company uses firewalls,128-bit SSL encryption, and 256-bit AES encryption—the strongest encryption methods available online and used by banks and the government.

Credit Sesame’s security practices are approved by Verisign. TRUSTe has also validated the company’s website privacy practices. McAfee SECURE certifies the Credit Sesame site is secure, passing intensive daily security scans.

Additional, Credit Sesame servers are located in a secure facility with 24-hour monitoring and surveillance.

Data is never shared with third parties unless specifically asked, and information is never sold to outside companies for marketing purposes.

Tags

Digital - FinTech

Fintech is radically changing how we live as society and how we do business professionally. We're looking for great apps and sites that are disrupting sectors such as mobile payments, money transfers, loans, fundraising, financial management.

More Details