Project Overview

H&R Block has stores across the United States, dedicated to offering a helpful and effective way for customers to complete the stressful task of preparing their taxes. However, their online tools lagged behind the in-store experience and often left users confused.

H&R Block hired Code and Theory to evaluate their existing online tax calculator and find a way not only to improve the user experience, but to make it a valuable resource in educating and converting new customers.

Project Commissioner

Project Creator

Project Brief

H&R Block hired Code and Theory to evaluate their existing online tax calculator and find a way not only to improve the user experience, but to make it a valuable resource in educating and converting new customers.

Project Innovation/Need

The H&R Block Tax Calculator was intended to serve as a tool that enabled users to learn about their tax return and calculate their projected tax refund in an easy, convenient and manageable way. We immediately saw that the lack of information architecture, system bugs (periods and commas could not be entered into the form), and slow load times, users could not accurately complete the forms.

After auditing competitor systems, we were faced with two prevalent design philosophies for online tax forms - an endless stream of “yes-no” questions (i.e. TurboTax), and a model that focused on more narrative and contextual questions to gather information (i.e. Jackson Hewitt).

In order to validate the effectiveness of these two concepts, we conducted intensive in-person user testing and research. Each participant was assigned a “role,” given time to delve into character, and asked to interact with the system in every possible user scenario the system could encounter.

Our team tested the two prevalent concepts and tested them against the existing H&R Block calculator. None of them worked.

H&R Block’s new tax calculator was created as a hybrid of the two models. The hybrid model garnered the clarity and simplicity of the question model, and the thoroughness and accuracy of the contextual model, while eliminating the tediousness of both. As a point to not impede on the speed of the process, the hybrid model grouped together specific questions regarding personal information, sources of income, and sources of expenses, as opposed to asking for this information one question at a time.

User Experience

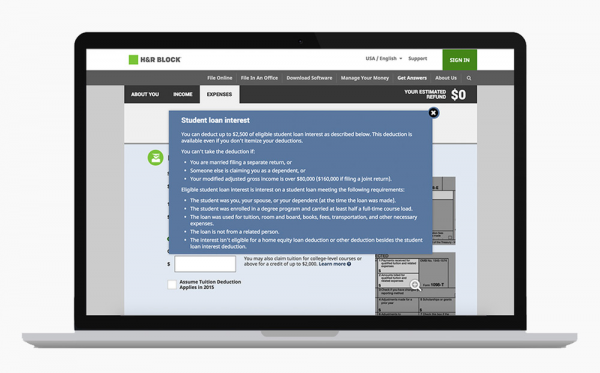

To prevent confusion and drop-off, detailed information and definitions were provided for familiar and unfamiliar concepts and terms. With the click of a question mark, a pop-up appears, to present the term in the context of the relevant tax form with specific definitions and explanations. Additionally, an easily digestible image displayed the relevant print version of the form section alongside the online form, allowing the user to follow along with printed forms delivered by banks and employers.

We created the capability for H&R Block to use elements of the calculator in a rich media advertisement that could be recirculated on other sites, extending reach to customers outside of H&R’s direct orbit.

To simplify the process further, information added by a user in the ad was captured, saved, and moved into the full H&R Block site experience after clicking.

Digital - Business Platforms

Business Platforms have succeeded in helping businesses in changing their focus to the achievement of outcomes. Compelling, flexible and scalable platforms that provide greater business agility and productivity will stand out here.

More Details