Project Overview

With customers at the heart of CommBank innovation and product design, the new CommBank app for tablet has been created with their tablet-user base at the forefront. With the new CommBank app for tablet, users now have the option of banking on an app designed specifically for their tablet device. The overall design and features leverage the tactile nature of the device as well as the screen size when compared to mobile and desktop. Moreover, the new features provide further insight into a user’s finances, allowing them to visualise both spend and savings potential.

Organisation

Team

Commonwealth Bank Mobile Development Teams

Commonwealth Bank UX/VD Team

Project Brief

With a portion of CommBank’s existing digital user base demonstrating a preference for banking via a tablet device, the need for a revamped tablet app was clear. The tablet user base were entering CommBank’s banking platform through three different entry points which emphasised the opportunity to consolidate and enhance the fragmented experience. Creating a new banking app for customers who were using their tablets to access NetBank through their tablet web browser, through the old tablet app and through the mobile app on tablet called for a new experience that was suitable to the common thread between them – the tablet device.

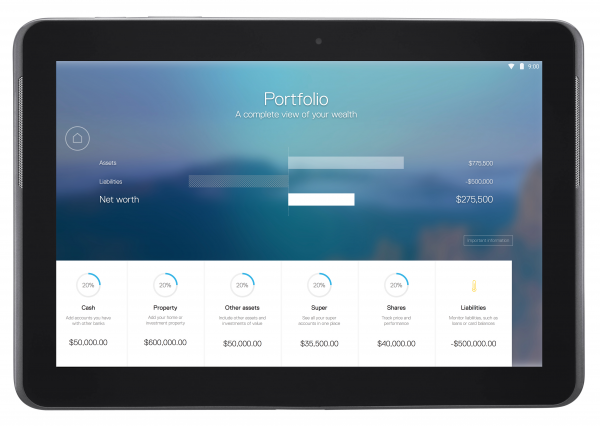

Not only did this innovation focus on the customer in terms of device experience, but it aimed to deliver new features and functionality that put the user in control of their finances. Portfolio, Running Balance and Savings Tracker provide users with insight and understanding to aid them in their financial management and financial wellbeing. The new CommBank app for tablet assists customers through education and empowerment which lead to a greater understanding of their position as well as the impacts that their decisions have, delivering to the CommBank vision.

Project Need

Given the large existing tablet banking user base, the new tablet app provides these customers with a better way to bank that is suited to their device and banking needs.

New features were introduced in the CommBank app for tablet, leveraging visualisations to provide users with new ways to view and manage their finances:

•The Portfolio feature displays both assets and liabilities in one snapshot, allowing customers to gain a better understanding of their net worth.

•Customers are also able to toggle between the Running Balance and Savings Tracker view.

The Running Balance feature provides customers with a tracking view of their finances over the last 35 days. By showing the closing balance per day and current balance for the current day, customers have an improved view of their everyday spending patterns in a more simplistic and visual manner.

Taking another lens, the Savings Tracker calculates possible savings, factoring in expected pay, current spend, pending debits and scheduled payments, framed by the user's pay cycle. This innovative feature sees CommBank taking on a more assistive role towards enhancing the financial wellbeing of their customers. By providing insight into their monthly savings potential, the new CommBank app for tablet empowers customers to make informed decisions about their finances.

Both the old and new features, packaged together in an enhanced design and layout, give the customer control, allowing them to continue banking as before while providing insights to help them understand their finances in a new way.

User Experience

The CommBank app for tablet leverages the nature of the device through its tactile nature and features that are both insightful and suitable for the user. The three new features; Portfolio, Savings Tracker and Running Balance, are presented in a highly visual yet simplistic manner, allowing the user to track, understand and manage their finances in a new way.

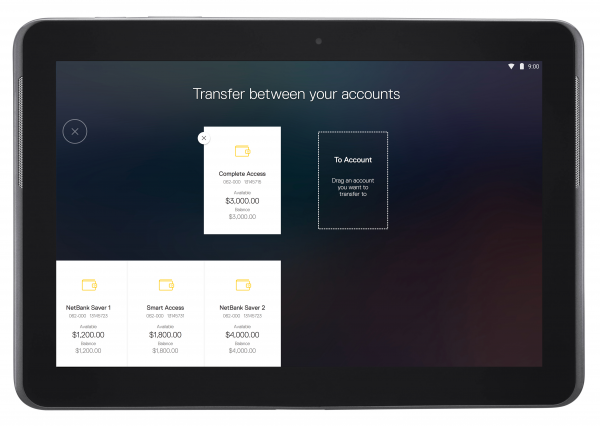

A large set of features from the old tablet app, NetBank and the mobile app have been made available in the new CommBank app for tablet, creating consistency and familiarity for transitioning users. They are able to engage with their finances in a similar manner through features such as 4-digit PIN logon, transfer money, pay bills via BPAY, view upcoming payments and transfers, schedules new ones, activate cards and change card PIN. However, new visual tools on existing features, such as drag and drop functionality when transferring between accounts, creates a more intuitive experience for the customer. Implementing tools catered for the device and thus, the user, shows CommBank’s focus on customer-centred design.

Moreover, the tablet user base were once apprehensive to the concept of mobile banking which informs their potential motivations to banking on their tablet devices. For this reason, the new CommBank app for tablet has been designed for the existing tablet user base, considering their banking needs and appropriate features as well as the device itself to ensure an optimal experience for these users.

Project Marketing

There have been several components of the launch of the CommBank app for tablet from a marketing perspective. Public relations played a large role to drive awareness of the app through an announcement launch which garnered the attention of Australian tech blogs and newsrooms. Their articles and publications largely praised CommBank’s upgrade of the old tablet app as well as the innovative features that were aimed at the financial wellbeing of their customers.

From a targeted perspective, a series of eDMs were dispatched to two subsets of customers:

• Customers using an outdated OS

• Customers who were accessing their tablet banking through other entry points (NetBank via their web browser, the mobile app and the old tablet app).

Clear communication regarding the new CommBank app for tablet and a call to action in each eDM has prompted the migration of existing customers. While not all customers have migrated over, there are other marketing initiatives in flight which are aiming to address the gap.

More recently, marketing efforts have focussed on leveraging our owned assets and channels to raise awareness and drive uptake. By placing messaging and a clear call to action to download on our ATM screens, in-branch digital merchandising and CommBank homepage banners, there is higher visibility for the general market. However, since migration from the old app to the new is a priority, leveraging owned channels targets CommBank customers specifically.

Project Privacy

The permeation of digital and our reliance on it in our everyday lives is growing at a rapid pace with innovation paving the way. With this continually-evolving shift, there are implications for customer and user privacy whereby there is potential disruption or a level of distrust.

Privacy is a major priority for CommBank since our customers are of the utmost importance to the business. There are strict security and privacy controls that have been applied to the way customer data is managed and the way their information is used.

In addition, the CommBank app for tablet is backed by a 100% Money Back Guarantee which allows customers to bank with peace of mind while reflecting the Bank’s commitment to providing security for their customers.

FinTech

Fintech is radically changing how we live as society and how we do business professionally. We're looking for great apps that are disrupting sectors such as mobile payments, money transfers, loans, fundraising, financial management.

More Details