Project Overview

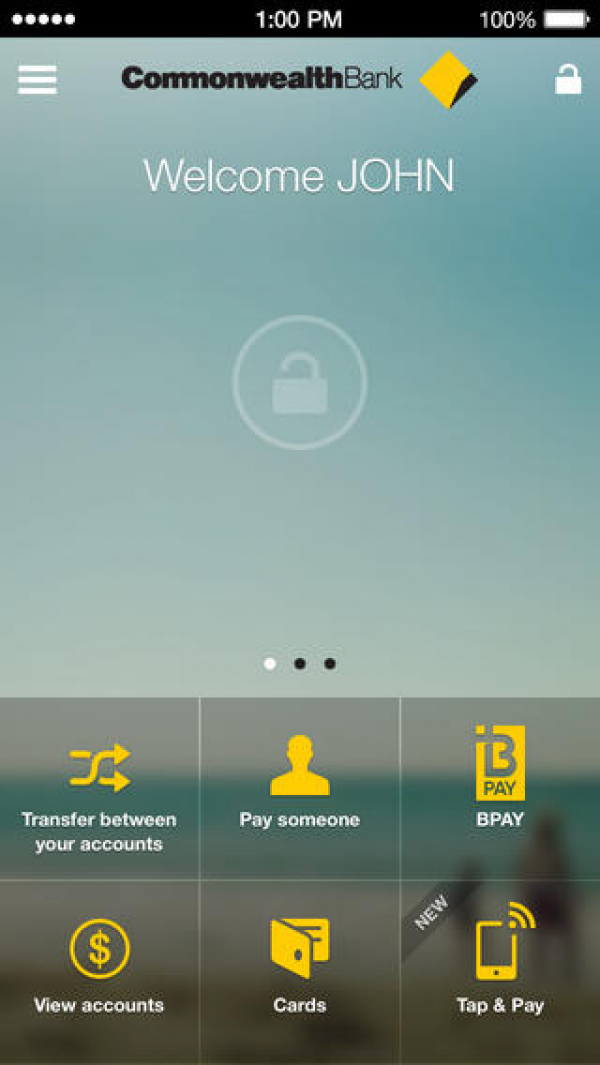

The Commonwealth Bank App is a world-class mobile banking experience that pushes the boundaries of mobile banking.

It lets you

View your account balance with one simple swipe

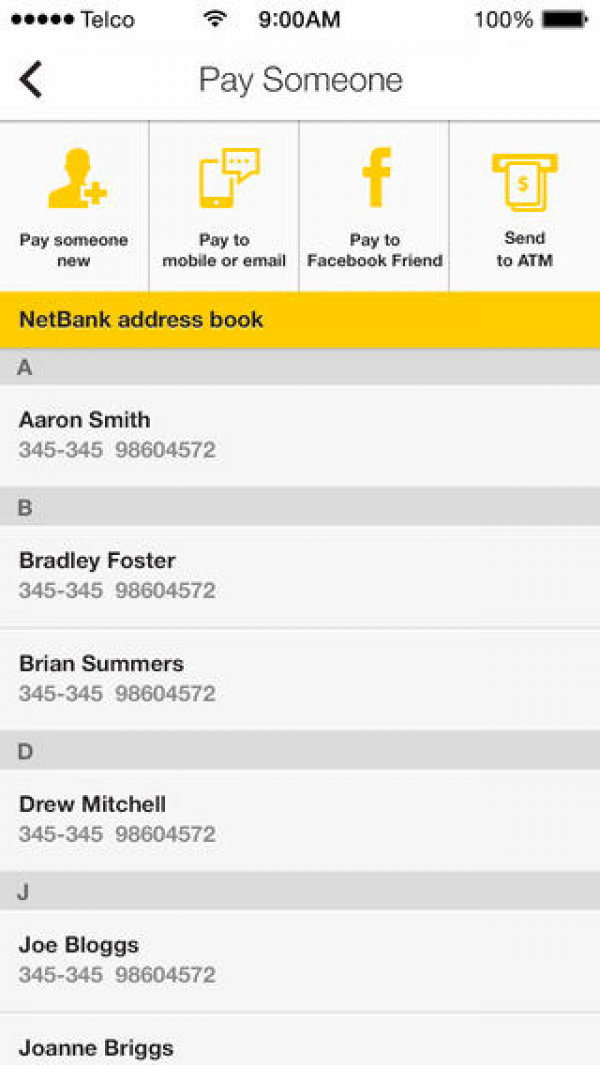

Pay via a mobile number, email address or Facebook contact

Tap & Pay with your phone at any MasterCard® PayPassTM terminal ( A worlds first for our Samsung S4 customers)

Use your phone at an ATM to get money with Cardless Cash

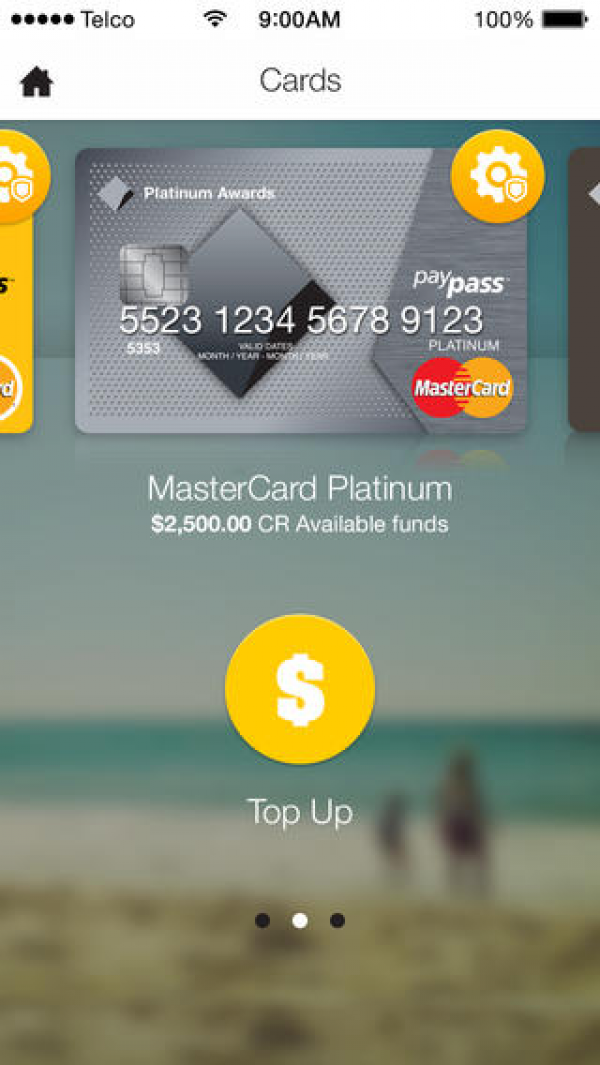

Easy control of your credit cards with Lock, Block and Limit (patent pending)

Organisation

Team

CBA Digital Channels Team

Project Brief

The Commonwealth Bank App is a world-class mobile banking experience that was driven by the bank’s commitment to internal innovation, lean UX and agile delivery.

This allowed us to move from inception to delivery in just 4 months.

It was designed in collaboration with our customers, which has driven an uptake of over 3 million users processing more than $1.1 billion per week since it was launched 5 months ago.

It has changed the way people bank, to the point where we have over half of our customers using only their mobile for banking on a weekly basis.

Project Need

Tap and Pay

Our users now have more freedom in how they choose to move their money. When we first launched they were able to pay others using a mobile number, an email address and even via Facebook.But we didn't stop there; soon after launch we delivered a world first, contactless payment service on Samsung S4 phones powered by MasterCard PayPass, moving closer to our goal of a truly mobile wallet.

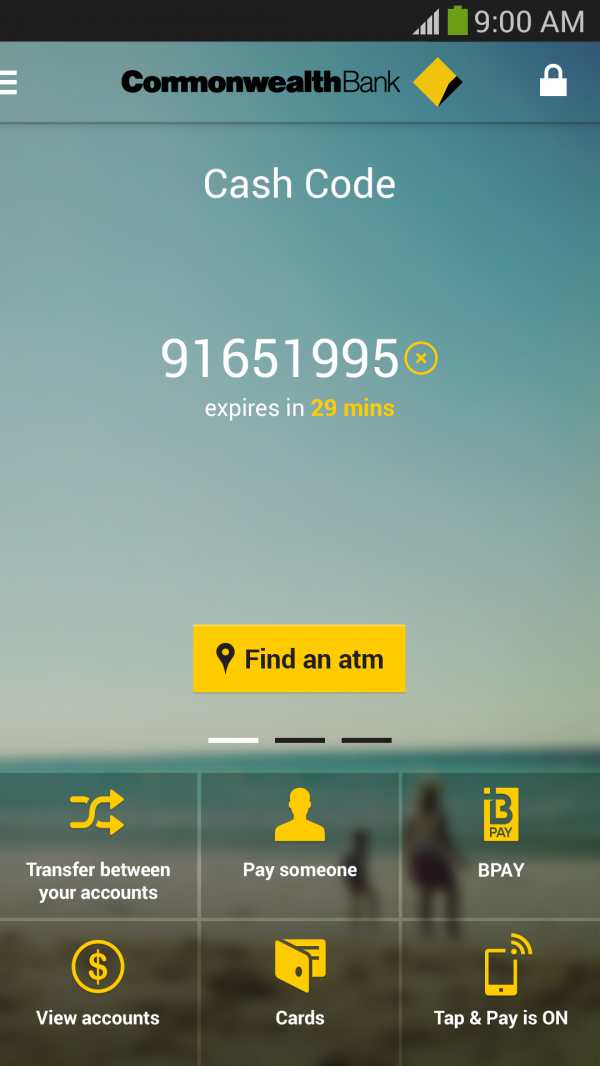

Cardless ATM withdrawals

For the first time in Australia, customers can access cash from an ATM using just the CommBank app on their mobile phone, with no need for a card. Gone are the days where customers have forgotten their wallet and cannot access cash.

If customers need to send money to someone else, that's easy too, just send them a code and they can collect cash from a CBA ATM - they don't even have to be a CBA customer.

We support great ideas from our staff and this one was the winner of an internal innovation ideas competition.

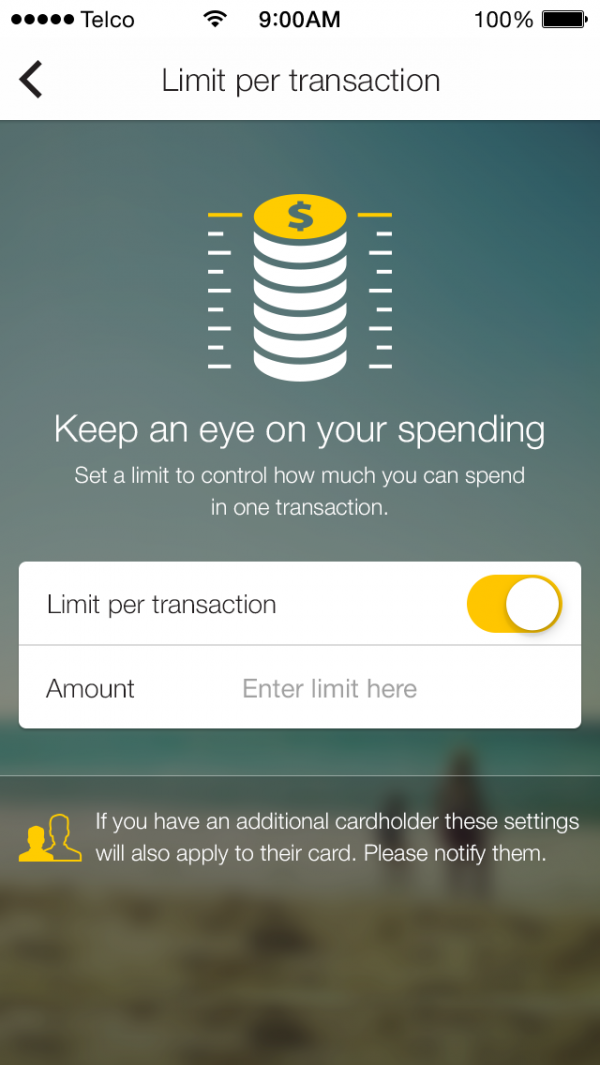

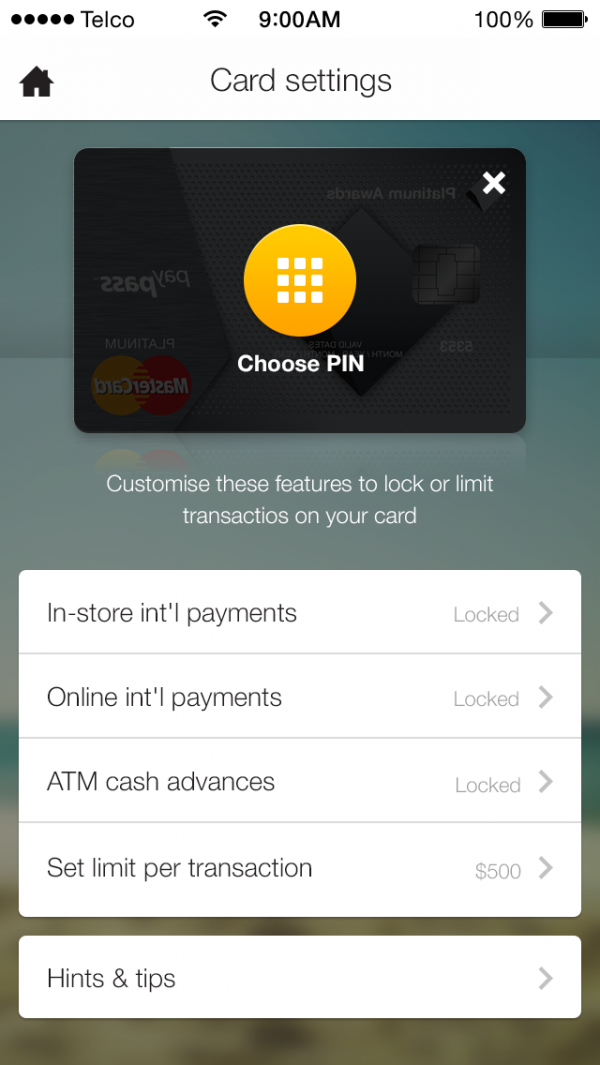

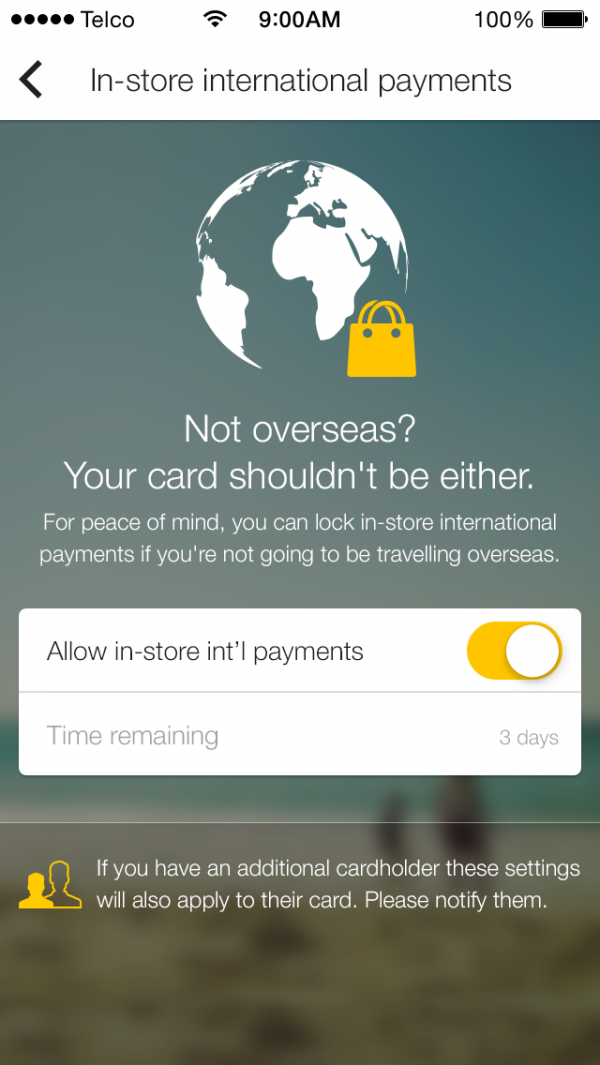

Lock and Limit

The ability to lock and limit credit card transactions is an innovative response to our customers’ concerns about security, providing the ability to customise the credit card to suit each individual’s spending pattern and security levels.

For greater peace of mind and convenience, Lock and Limit offers credit card customers the ability to control spending on their cards by either applying a lock for overseas in-store transactions, overseas online transactions, ATM withdrawals or setting a specific transaction limit.

If you're not overseas shopping, your card shouldn't be either. We give our customers a level of security and control across our app that other banks have yet to deliver.

User Experience

We have an extensive UX capability at CBA and our mobile UX team used a Lean UX approach to validate with users every two weeks. We used a combination of methods from user testing to larger panels to get quantitative readings on customer needs. Then end result was that we didn't just solve the problem in a way that's easy to use, we solved the problems our customers desired most.

How do our customers feel?

The app is consistently the number 1 free finance app in the App store and Google Play. It has generated passionate feedback from our users:

"Love it...I moved to CommBank because of this app" (App store review, 21 March)

"I am considering an account with them just so I can pay with my phone. I've tried contacting key ANZ staff but no luck...." (Facebook comment, 19 March.)

‘This is by far the premier banking app in Australia’

‘It’s not often that I get an app that just works. This one does! This is very polished and works as you would hope. It does what it says it will, flawlessly. Simply terrific’

‘Hello Commbank guys, I must tell you this app is the best in the world. I am so happy that I am a commbank customer. The work you guys do to make ur customer happy is unbeatable’

Project Marketing

The CommBank app has been promoted on social media such as Twitter and Facebook with explanatory videos and comments designed to engage customers and demonstrate the different features. This has generated conversation and buzz, as well as calls from our customers to competing banks to follow CBA’s lead. The focus is always on how to help customers with their lifestyle. Since the app’s launch in December 2013, there have been three above the line marketing campaigns. Each has focused on a particular feature which is innovative and can help create convenience for the customer:

1) CAN Tap – this featured tap dancers to promote the Australian-first Tap & Pay feature – see video below

2) Cardless Cash – this featured an animated wallet to promote the Australian-first Cardless Cash feature – see video below

3) Lock, Block & Limit – this featured one of Australia’s top magicians to promote the world-first card locks – see video below

These marketing campaigns have been well-received by customers, have high recall, and help contribute to CBA’s overall brand positioning as a leader in technology.

Project Privacy

Security and privacy are key drivers for the CommBank App as our research tells us how important these are to our customers, particularly for mobile banking. Security has been paramount in designing the app which conforms to industry best practice and standards. Privacy of customer data is a core principle of all of CBA’s banking services and internal systems and processes are designed to ensure customer data is stored securely and privacy is preserved. These criteria inform all of our decisions about feature development. For example, customers are able to view a ‘simple balance’ prior to logging in within the app for greater convenience. However, early feedback from customers via social media and app store reviews suggested that some customers were concerned about the privacy implications of this feature. Although it was already an optional feature and could be turned off in the app settings, we felt that this had not been presented clearly enough to customers so in the next release we added a ‘Turn off simple balance’ button in order to make this option very clear. The app undergoes extensive security testing before each back-end and native release and goes through risk assessments, security testing, penetration testing and a series of checkpoints before going live.

Mobile Payments

The category relates to applications developed to facilitate the transfer of funds over the mobile platform.

More Details