|

|

Project Overview

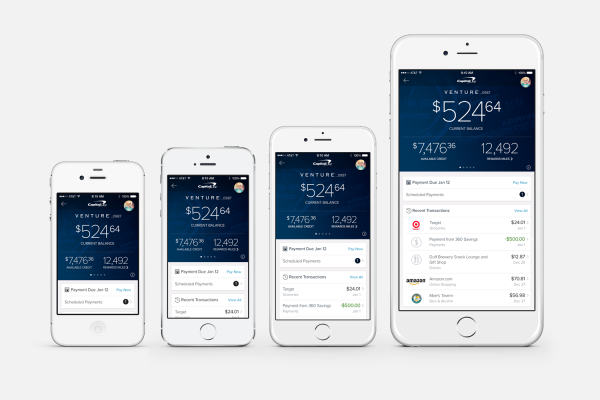

We’re excited to introduce an updated Capital One mobile app for our iPhone customers. Take advantage of new-and-improved features, designed to make mobile banking easier, simplified, and more welcoming. See all of your accounts together and interact with us in a more conversational way. Our mission was to better understand the unmet human needs involved in the multi-product money management experience and find ways to solve them. We think you'll love it!

Organisation

Team

Ron Secrist

Robbie Dillon

Toby Russell

Scott Zimmer

Heather Marcel

Keith Forsythe

Major Highfield

Stacey Yan

David Harmony

Kelly Toton

Bruce Hoang

Richie Hollins

Jason Bryant

Beth Shoup

Dan Cottner

Blair Christopher

Jimmy Jones

Jonathan Blocksom

Sean Overby

Jimmy Sambuo

Chad Landis

Alex Cabanilla

Benjamin Scazzero

Jeff Small

Luis de la Rosa

Nick Sheehan

Mark Anderson

John Lawrence

Marcus McConnell

Ranjit Kasanboina

Dinakar R Emani

Ramesh Thatavarthi

Project Brief

We started with the customer, striving to understand their underlying needs. We used a number of research methodologies, including focus groups, usability tests, and hundreds of hours of empathetic interviews with both customers and non-customers. We uncovered a significant need to bring humanity and advocacy to a product and industry that has historically been cold and intimidating. We recognized the poor user experience of multiple places to service your accounts. We are driving an experience that makes you want to deepen relationship and be able to do what you need with ease, personalize your experience, and speak in a friendly tone. We utilized an Agile method to develop and deliver the app with a focus on continual improvement and iteration based on customer needs and feedback, as well as research driven product improvements. We’ve also created a scalable technology approach that we’ll be able to reuse for other apps and a new desktop experience to truly change banking for good.

Project Need

Our mission was to better understand the unmet human needs involved in the multi-product money management experience. We uncovered insights that were able to guide design and exploration.

Bring Humanity.

Consumers want to be treated as a person, and they want the brands they interact with to understand their needs and situation. There is an opportunity for banks to “humanize” the banking experience and mobile seems to be in a strong position to deliver on this promise because being more connected should ultimately provide a more personal connection.

Be an advocate.

Consumers feel that they’re not in control when it comes to their banking relationships and don’t feel they know or understand the rules until they’ve broken them and are penalized. There is an opportunity to be the bank that helps people help themselves. Consumers are looking for guidance but want to be able to choose how and when they accept advice.

Be Fast and Convenient.

Consumers are comfortable with digital technologies being integrated into their lives, but not running their lives. Ultimately, digital and mobile innovations should make the rest of consumers’ lives easier, not more complicated. Mobile technology should be able to solve problems and meet needs that other banking interactions are not able to address. Digital solutions should be about the benefit that can be provided, not about the new technology that can be leveraged. There is an unmet need in helping consumers integrate their banking and finances more seamlessly.

User Experience

Personalize.

Add a profile image, so you'll see a familiar picture when you sign in. Give your account a custom nickname to make your mobile banking experience even more unique. Tap your profile to control your notification settings, contact us, or change how you sign in.

More accounts in one place.

Now more accounts are consolidated in one convenient place. Check out your balances for banking, credit card, and home and auto loan accounts – all on one screen. Your simplified financial summary is at your fingertips.

Swipe between accounts.

Select an account, and swipe left or right to scroll through each one. With a sleek new look and interactive design, we made it easier than ever to access account details from your phone.

Say goodbye to password typos.

Choose a new way to sign in securely without all the tapping. Create a pattern password with SureSwipe, or use Touch ID to access your accounts lightning-fast using your fingertip.

View transactions in detail.

We've spruced up your transaction details, so you can see a business' full name, address, contact information, and map location. That way, you'll know exactly who, what, where and when once a transaction posts.

Expanded account details.

Find your most important account information in a tap. See the term, interest rate, current balance, and past payment on your credit card or loan account. Or, get key banking stats like your account number, statement balance, and rewards.

Project Marketing

When we launched our new Capital One app for iPhone, we went straight to our biggest critics – our Customers. For the first time ever, we gave our Customers the ability to see and manage their Capital One® Credit Card, 360, Bank and Home and Auto Loan Accounts. They spoke, and we listened.

We even gave 100,000 of our multi-product Customers the chance to take the new app for a test drive and give us feedback a month before we launched it. We’re thrilled to say it received rave reviews.

Once we released the real deal, we reached out via email to all our multi-product Customers to share the good news. Not to mention we created a kick-butt landing page that highlighted all the cool, new features.

After that, we went out to Customers who have never used our Capital One app to show them just what they were missing – paying bills, transferring money, depositing checks, viewing account balances and more - all on the fly. Not to mention the ease of signing in with Touch ID and SureSwipe.

Yep, we’re pretty psyched about the app, too.

Project Privacy

At Capital One, we take privacy very seriously. Whether it’s in native apps, web presences, or offline interactions, our customers’ privacy is of the utmost importance. Unique to this app, we use device recognition technology and encrypt your mobile banking data. Passwords, personal information and actual banking are not stored on the mobile device and usernames are encrypted. That’s all we can share publicly, but even more is done behind the scenes!

We also follow all Federal guidelines for protecting our users’ privacy, as well as taking care to guard children’s privacy via the guidelines provided by COPPA (Children’s Online Privacy Protection Act.)

In addition, we strongly adhere to Apple’s guidance with respect to allowing the user to opt-in to services. That includes providing location, which we use to show nearby branches and ATMs, as well as the usage of the camera to take a picture to personalize their account with a custom avatar.

FinTech

Fintech is radically changing how we live as society and how we do business professionally. We're looking for great apps that are disrupting sectors such as mobile payments, money transfers, loans, fundraising, financial management.

More Details